The Bank Of Canada Maintains Its Interest Rate At 5 Percent, As Anticipated At a Glance

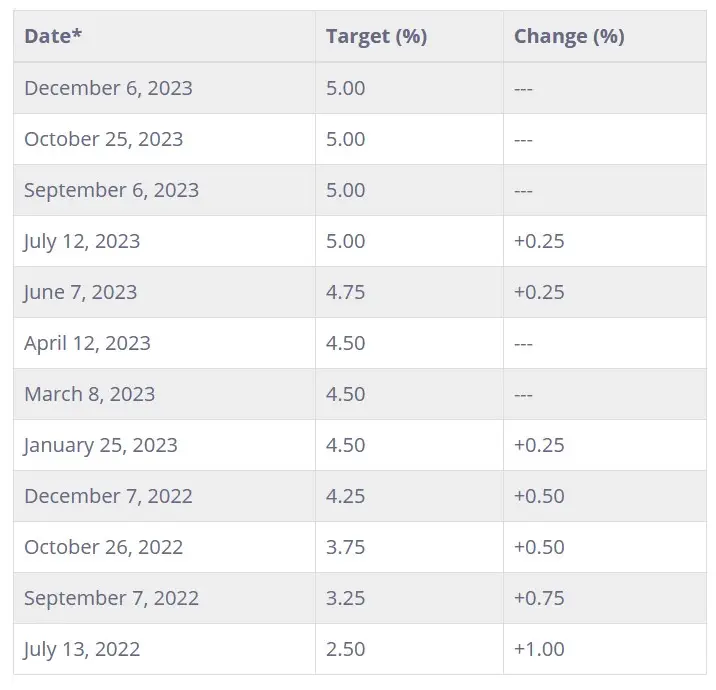

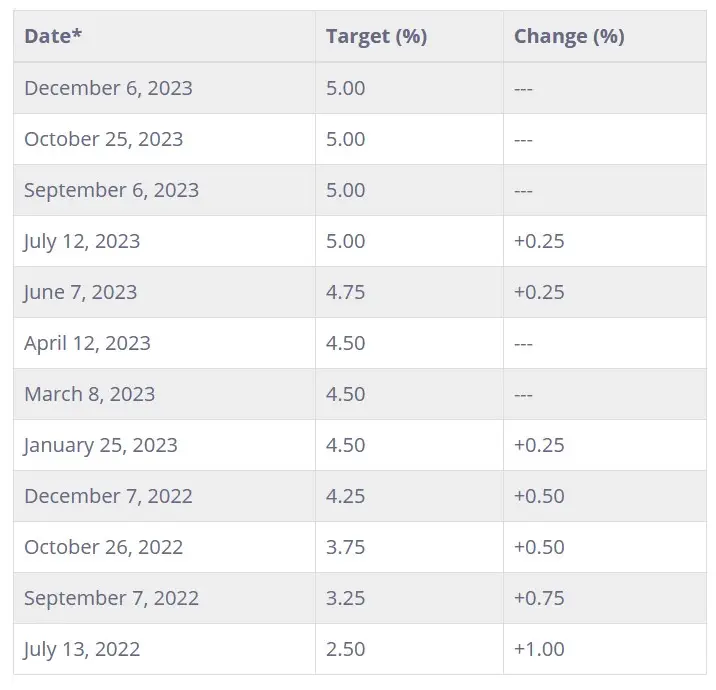

The Bank of Canada has decided to keep its benchmark interest rate at five percent, as the Canadian economy shows signs of cooling. The bank has raised the rate 10 times since early 2022 to slow down runaway inflation but has recently signaled that it may be nearing the end of that hiking cycle. Economists who monitor the central bank think it is now done with hiking, and expectations are that the bank will start to cut its rate sometime in 2024. Despite this, the bank took great pains to note that it is still willing to raise rates by even more, should the need arise.

The Details of The Bank Of Canada Maintains Its Interest Rate At 5 Percent, As Anticipated

The Bank of Canada has decided to keep its key interest rate steady at five percent, as expected. This comes after the bank raised rates 10 times since early 2022 to combat high inflation. However, recent signals from the bank suggest that it may be nearing the end of its rate-hiking cycle.

The bank’s rate affects the rates that Canadians receive on loans and savings accounts. The current rate was set in July and has remained unchanged since then, as the Canadian economy shows signs of slowing down.

The bank stated that the slowdown in the economy is reducing inflationary pressures on a wide range of goods and services. Economists believe that the bank is now finished with rate hikes and may actually begin to cut rates in 2024.

While the bank indicated that it is still willing to raise rates if necessary, some economists believe that this is just a precautionary statement to prevent markets from assuming that rate cuts are imminent.

The bank’s decision to hold rates steady was not surprising, as it marked the third consecutive time that rates remained unchanged. However, there is speculation about when the bank will start cutting rates, but the bank has given no indication of when that may happen.

Despite the bank’s statement about potential rate hikes, many economists and market watchers believe that rate cuts are more likely. They argue that the central bank will have to cut rates as the unemployment rate rises and spending in the economy declines. However, the bank wants to see further easing of underlying price pressures before making any decisions.

While financial markets predict rate cuts to start in the first quarter of next year, some commercial banks expect cuts to begin in the second half of next year. The Bank of Canada’s next rate decision will be announced on January 24th.

Ultimately, the timing of rate cuts will depend on how the economy performs in the coming months. The Canadian economy has struggled this year, weighed down by higher borrowing costs. GDP contracted in the third quarter, and the labor market has weakened.

Overall, economists anticipate a sluggish year ahead for the Canadian economy, as it adjusts to the previous rate hikes.

Wrapping Up

The Bank of Canada has decided to maintain its benchmark interest rate at five percent, as expected. The bank has been raising rates over the past year to combat inflation but has recently indicated that it may be reaching the end of its hiking cycle. The decision to keep rates unchanged was influenced by signs of a cooling Canadian economy and a reduction in inflationary pressures. Economists predict that the bank will begin cutting rates in 2024. While the bank stated its willingness to raise rates further if necessary, some believe it is an empty threat. The central bank is still cautious about the inflation outlook and remains prepared to raise rates if needed. However, there has been a shift in their messaging, with officials suggesting that the economy is approaching balance and interest rates are restrictive enough to bring inflation back to the target.

The decision to maintain the interest rate comes as the central bank observes weaker growth and a cooling job market, indicating that demand is no longer outpacing supply. While the bank has not provided hints about when rate cuts may occur, financial markets and economists expect rates to be lowered in the future due to rising unemployment and a slowdown in spending. The next rate decision and updated economic forecasts from the Bank of Canada are scheduled for January 24th. The timing of rate cuts will depend on how the economy performs in the coming months, as higher borrowing costs continue to weigh on the Canadian economy. Overall, the Bank of Canada’s decision to hold rates steady reflects ongoing concerns about inflation and a desire to restore price stability.