Westbank, a Real Estate Developer, is Dealing with a Barrage of Lawsuits from Canadian and U. S. Projects Because of Unpaid Invoices

The Details Of Westbank is Dealing with a Barrage of Lawsuits from Canadian and U. S. Projects Because of Unpaid Invoices

Westbank Corp., a well-known Canadian developer with a reputation for ambitious architecture, is currently facing problems with unpaid bills for multiple projects in Toronto and Seattle. Numerous contractors have claimed millions of dollars in unpaid fees, resulting in a rise in lawsuits and liens over the past year.

The construction industry has been particularly affected during this challenging period, as borrowing costs and construction expenses continue to soar. Westbank has found itself entangled in disputes with over two dozen construction and trade businesses regarding unpaid bills. It is important to note that these allegations have yet to be proven in court.

Listen to this article:

In response, the Vancouver-based developer has refrained from providing detailed comments on the ongoing disputes, as they are still under negotiation or litigation. However, Westbank has expressed its expectations of reaching a resolution for these matters. The company also emphasized that construction delays caused by the global pandemic are not exclusive to its projects, but rather a common challenge faced by the entire industry.

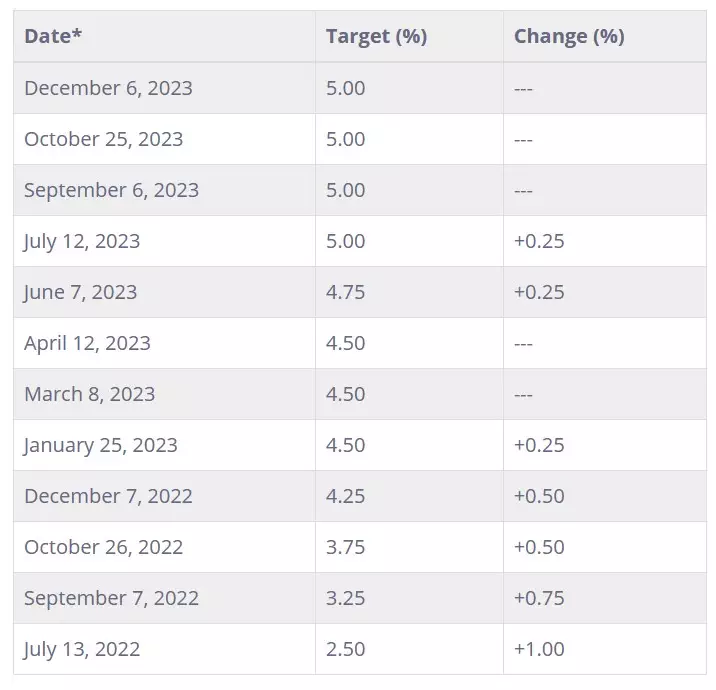

Similar to other developers, Westbank has faced significant increases in the costs of materials and labor, as well as rising borrowing costs. Residential construction expenses have risen by 58% over the past three years. Additionally, the prime interest rate charged by banks has reached its highest level since the beginning of the century, currently standing at 7.2%.

These sharp escalations have resulted in financial difficulties for several other Canadian developers throughout the year. For instance, Sam Mizrahi’s luxury condo project, The One, defaulted on $1.6 billion in debt payments and was put into receivership in October. Vandyk Properties faced similar consequences as lenders placed several of their developments into receivership after defaulting on over $183 million in loan payments. StateView, a residential builder located north of Toronto, also faced receivership after defaulting on $349 million in debt payments.

In Vancouver, Coromandel Properties filed for creditor protection when its lenders demanded repayment of over $200 million in loans. Onni Group, a developer with properties in various North American cities, has also been sued by multiple contractors in British Columbia for unpaid bills.

While other Canadian real estate developers have faced legal actions and creditor challenges, Westbank stands out as one of the largest and most prominent developers experiencing a considerable amount of litigation and claims from unpaid creditors. Though the individual amounts of some liens may not be substantial, the high volume of claims and ongoing litigation suggest developer-facing conflicts with trades on multiple fronts.

Over the past decade, Westbank has expanded its projects across Seattle, Toronto, and Vancouver, leading to a delay in completion dates for skyscraper projects. Westbank and its ex-general contractor, Graham Construction & Management Inc. were accused by >12 construction companies in Seattle, of not providing payment for work conducted at residential complexes called Museum House and WB120.

The issues began to surface in 2022 when Graham was removed as the contractor for Museum House. As the general contractor, Graham was responsible for hiring specialists in various areas such as welding and window installation. When Graham was replaced, subcontractors turned to Westbank for their payment, resulting in a pile-up of bills. Twenty-two subcontractors have since placed liens on the Terry project (Museum House), Graham, and Westbank’s development company, Icon West.

For instance, High Rise Glazing Specialist LLC filed a lawsuit in December 2022, claiming that Graham and Terry failed to pay $1.45 million for work completed between June 202 and June 2022. However, Graham and High Rise Glazing have not responded to requests for comment. There is a tentative trial scheduled for next year.

Furthermore, subcontractors are continually placing liens against the Terry project. Most recently, Zuhause Design LLC filed a lien on November 8, 2022, demanding payment of $231,781.

Situation In the Volatile Construction Industry

Overall, Westbank’s current situation reflects the challenges faced by developers in a volatile construction industry. While negotiations and resolutions for unpaid bills are ongoing, the company remains committed to progressing with its projects, despite the difficulties caused by the global pandemic.

According to the law in Washington State, a lien becomes unenforceable after eight months if the person who filed the complaint doesn’t follow up with a lawsuit. However, many contractors choose not to take this step because it can be very expensive. Even if some liens on the Terry project have expired, it doesn’t mean that the contractor’s unpaid bills have been resolved.

When there is an active lien on a property, it lowers its value and prevents the developer from refinancing unless they pay the unpaid bill or obtain a bond to replace the lien.

Even though Westbank has released some liens by posting bonds, it doesn’t mean that the subcontractors have received their payment.

Iris Window Coverings NW Inc. is one of the subcontractors affected. They provided automated draperies for the Terry project and have an outstanding bill of US$123,178. Westbank posted a bond of US$184,000 to release the lien, but Iris Window Coverings has not received any of that money and is now facing financial difficulties.

A similar situation has occurred at WB120, which consists of two skyscrapers with about 1,000 apartments. Several subcontractors filed liens against the project over the past two years, with the latest one filed in December. One of the subcontractors, Zuhause, placed a lien of US$13.5 million due to unpaid work. Zuhause started work on the project in June 2021.

Westbank was also involved in litigation with the general contractor, Graham, over a US$50.1 million lien filed against the WB120 project. The general contractor accused Westbank of not paying for work done from April 2018 to November 2022. Graham countersued when Westbank took Graham to court trying to reduce the amount of the lien. Although the lien was eventually reduced to US$42.5 million and released, the lawsuit remains open.

Having a large number of liens filed against a developer is usually seen as a sign of funding issues and other problems.

In the case of Westbank, the company usually acts as its own general contractor for its projects. However, in Seattle and Toronto, where it is building various properties, Westbank hired EllisDon Corp. as the contractor. The relationship with EllisDon began to deteriorate in 2022, and Westbank took over as its own contractor for both projects.

EllisDon, one of the top construction management companies in the country, filed a legal action against Westbank in June for missed payments at Mirvish Village. They also filed and then dropped a separate claim for $4.4 million owed on another project, Duncan Street.

Westbank is a company that’s involved in building the King Toronto condo project, which is currently being constructed. However, they have faced some legal issues recently. Three other construction companies have sued Westbank for unpaid bills related to the Mirvish site. Westbank’s executive, Ian Duke, acknowledged that these situations can be complex and take time to resolve. He also mentioned that removing EllisDon, one of their contractors, has been a disruptive decision but disputes with trades are a normal part of the business.

However, other industry executives warn that allowing contractor relationships to deteriorate like this can be costly in terms of reputation, time, and money. Bryan Levy, the CEO of Toronto-based DBS Developments, emphasized the seriousness of not paying key trades.

Westbank started in the 199s with the construction of shopping malls and high-end condo buildings in Vancouver. Over the years, they have taken on more high-profile projects, including the Shangri-La Tower, the redevelopment of Woodward’s department store site, and the Fairmont Pacific Rim hotel.

The company expanded to Toronto in 2012 and continued to grow in Vancouver, Toronto, Seattle, and San Jose. They also ventured into Asia, with projects in Tokyo and offices in Taipei, Shanghai, and Hong Kong.

Like many developers, Westbank took advantage of low-interest rates to launch new projects. However, as interest rates have risen, they have faced challenges in completing projects on time. Some of their projects in Seattle and Vancouver have experienced delays, and sales of condo units have been slow.

The rise in interest rates has also impacted Westbank’s construction loans. For example, a loan they took out in 2018 for their Alberni condo project now has a much higher interest rate due to rate increases by the central bank.

Late payments have become more common in the development industry, which puts financial pressure on small suppliers. Craig Macklin (president), of Lumbermens Credit Group Ltd., expressed concerns about the impact of extended cash crises on these suppliers. He also mentioned that delays in payments can lead to further delays in completing building projects.

Iris Window, a drapery supplier in Seattle, is one of the companies waiting to get paid by Westbank. They have struggled with rising inflation and labor costs, making it difficult to make money on contracted jobs.

Overall, while Westbank has faced challenges and legal issues, its major partner Allied REIT has expressed confidence in their ability to meet their obligations. However, it is important to monitor the situation and consider the potential impact on the company’s reputation and relationships with contractors and suppliers.

Summary

Canadian developer Westbank Corp. is facing legal action from several contractors claiming millions of dollars in unpaid bills at projects in Toronto and Seattle. The company, known for its ambitious architecture, has been hit with more than two dozen lawsuits and liens over the past year as borrowing costs and construction expenses soar. Westbank has not commented on the individual disputes, but said it expects to reach a resolution. The Vancouver-based firm has had to contend with a significant spike in costs for materials and labour, along with soaring borrowing costs.

Westbank, a Canadian real estate developer, is facing multiple liens and lawsuits from subcontractors over unpaid bills for its construction projects in Seattle and Toronto. While Westbank has released some liens by posting bonds, subcontractors claim they have not received payment. The situation has led to financial struggles for some of the affected companies. Experts say a large number of liens filed against a developer is seen as a red flag of problems with funding. Westbank has traditionally served as its own general contractor but broke the pattern in Seattle and Toronto, where it is building offices, condos, and rental apartment buildings. However, the relationship with its general contractor began to fray in 2022, and Westbank took over as its own contractor from EllisDon on both projects. Three other construction companies sued Westbank for unpaid bills over the Mirvish site in September and October.

Westbank, a major Canadian real estate developer, is facing financial pressure due to rising interest rates and delays in completing some of its high-profile projects. The company, which has expanded into Vancouver, Toronto, Seattle, San Jose, Tokyo, Taipei, Shanghai and Hong Kong, has taken out construction loans with variable interest rates that have increased significantly as central banks have raised rates. Some of its projects have also been delayed beyond their original completion dates. While Westbank has not disclosed specifics about its project financing or partnerships, it has received support from major partners such as Allied REIT.

The King Toronto condominium project by Westbank has been delayed due to the bankruptcy of its window-wall contractor, Integro Building Systems Inc. This has caused issues for sub-trades like Iris Window, a Seattle drapery supplier, who are waiting to get paid by Westbank. Iris Window has struggled to make money on fixed-price contracts due to rising inflation and labor costs. Westbank recently contacted them to see if their bids for another delayed project were still valid, but Iris Window declined due to their financial situation.